The trend of furniture industry

- 2024-01-12

For many years, Taiwan has stood tall as a bastion of manufacturing, with our furniture industry being a hallmark of that legacy. Taiwan's furniture sector has achieved notable successes, securing a firm foothold on the global stage. However, given the evolving global economic landscape, inflation, and changing consumer preferences, it's imperative for our manufacturers to consistently adapt and innovate to remain at the forefront. We are glad to invite Mr.Sam Chen , Honorary Chairman of the Taiwan Furniture Manufacturer Association(TFMA), to express his views on the future development of Taiwan's furniture industry. The highlights are as follows: Environmental Sustainability: As global awareness of environmental issue increases, there’s an escalating demand for sustainable and eco-friendly products. Embracing green materials and methodologies not only safeguards our planet but also aligns with international market demands. Smart Home Furniture: The technological surge, paired with the internet’s ubiquity, has opened new horizons for the furniture domain. Future furniture, endowed with smart sensors, could offer adaptability and automation, enhancing both user convenience and comfort. Moreover, virtual reality might revolutionise furniture design. Customization: Tailor-made furniture is poised to be a dominant trend. A growing number of consumers, particularly the younger demographic, seek to articulate their unique identities through their furniture choices. Global Market Outreach: While Taiwanese furniture has garnered international acclaim, there’s ample room for growth. Engaging in global furniture expos via our association can further amplify our export endeavours. Educational Initiatives and Skill Development: To cater to emerging demands and innovate, Taiwan must champion the education of the ensuing generation, fostering top-notch designers that elevate our industry's global standing. The Rise of the Pet Kingdom: 2022 data highlighted an interesting trend: the number of registered pets in Taiwan outstripped newborns. As pets increasingly become beloved family members, the realm of pet furniture beckons as a burgeoning market opportunity. In summation, while the horizon for Taiwan’s furniture sector remains luminous, it behoves us to relentlessly innovate, attuning ourselves to the mutable market dynamics and consumer desires. Together, let us navigate this journey with vigor. Source: TFMA

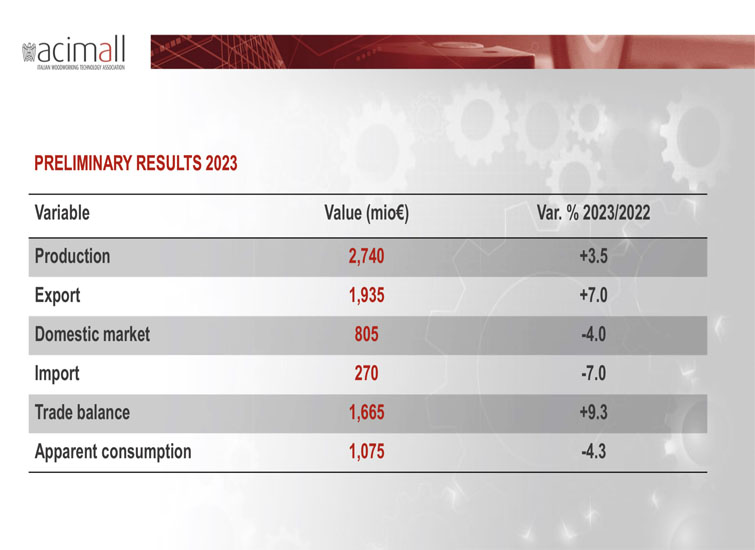

TECHNOLOGY FOR WOODWORKING AND THE FURNITURE INDUSTRY: ANOTHER POSITIVE YEAR IN 2023 (plus 3.5 percent)

- 2024-01-11

The preliminary balance of 2023 drafted by the Studies Office of Acimall shows 3.5 percent growth of production compared to 2022. So, despite a trend of orders that was much less satisfactory than the excellent results of the past years, the companies had and still have a strong order backlog, allowing them to increase their revenues also in the year that’s going to end. After the 5.3 percent increase achieved in 2022 over the record year 2021, this trend indicates the full health of the industry companies, who had the opportunity to invest and strengthen their position in Italy and, according to tradition, all over the world. The value of production reached up to 2.74 billion euro, net of inflation, but still an all-time record for the woodworking machinery industry in a period when all mechanical industry domains, machine tools above all, are experiencing the same situation. Export – which account for approximately 70 percent of total revenues – increased by 7 percent (1.935 billion euro in value), while sales on the domestic market are falling (805 million, down by 4 percent from 2022), also reflected by the significant decrease in import (270 million in value, minus 7 percent compared to the previous year). The Italian market is going through a less positive period and it could not be otherwise, considering that the investments made by users in recent years have reached significant levels, actually saturating the equipment fleets. Therefore, the reduction is natural and expected, and it must be evaluated accordingly. The reduction of apparent consumption amounted to 4.3 percent, down to 1.075 billion euro, showing the consistently strong demand of wood and furniture technology in Italy, which remains the fourth global market after China, the United States and Germany, and before Vietnam at number five. It is also worth noticing that, also in 2023, the industry of wood and wood-based material technology maintained an excellent performance in terms of trade balance, with an active result by 1.665 billion euro, 9.3 percent higher than in 2022; this is definitely one of the most significant results in the entire landscape of machine tools and a great contribution to the total Italian result. THE YEAR 2024 As mentioned, for a few quarters now, the woodworking machinery industry has moved back to more “normal” values, after the booming trend of recent years, and it is expected to follow the same trend also in 2024. “Such values can hardly be estimated today, due to the tragic international events we all know, that might have a heavy impact on the global economy”, said Acimall’s director Dario Corbetta. “Our industry is also subject to ups and downs, with positive periods alternating with less satisfactory ones: the news – so to say – is that the growth in the past years was so powerful to generate a peak, a strong discontinuity that will require a slow return to normal, hence the persistence of negative values over a long time, though with lower rates”. “However, there is a feeling that the industry is worrying excessively for what can be considered a natural slowdown”, Corbetta continued. “2023 figures are showing this, and today, the companies are definitely much stronger in terms of financial capacity and organization, compared to previous, much more difficult periods: as a result, they will be able to face a business reduction that we can call “normal”, though apparently magnified by the extraordinary results of the previous three years”. INDUSTRY 5.0 Undoubtedly, in recent years, the Italian market has been “stimulated” by measures that encouraged different types of investments. And also for the next season, there are variables that might affect the results to a significant extent. We are referring to measures included in the “Industry 5.0” plan, within the framework of the national recovery and resilience plan (Pnrr), approved by the European Commission as consistent with the “REPower EU” plan, aimed at accelerating the transition of EU countries to clean power , and more generally, at the adoption of energy-saving measures. The new facilitations introduced by Italian financial institutions fit into this context, supporting investments that meet the standards of connectivity and integration into the enterprise management networks envisaged by “Industry 4.0”, and ensuring less power-hungry operations in addition. “For the 2024-2025 period, companies will have access to tax credits for a total value of 6.3 billion euro, to be added to the benefits of “Industria 4.0”, a plan created to support all measures for the energy efficiency of machines and plants”, Dario Corbetta said. “The shrinkage of recent months might have been driven by many companies which decided to wait for the full deployment of the new measure before making new investments. Saying that such measures are “appreciated” is a clear understatement, despite their “elastic” effect on demand. Longer-term policies that do not overlap year after year would certainly have more enduring and structural effects on demand trends”. There are elements for cautious optimism, and for sure, Xylexpo 2024 – the biennial international exhibition of technology for the wood supply chain organized by Acimall to be held at FieraMilano-Rho next May 21 to 24 – comes right on time to help potential customers and users leverage the innovation in terms of energy efficiency that will characterize the entire portfolio. Source:ACIMALL

“High turnover.

- 2024-01-04

We were honored to interview Joe Chang , the chairman of TWMA to share and his thoughts on the future of woodworking machinery in 2024. The key points here are as follows: In the years 2020 and 2021, Taiwan's woodworking machinery industry experienced a compound growth of 54%. However, the period from 2022 to 2023, there was a significant compound decline of nearly 70%. This decline is not limited to the woodworking machinery industry but extends to Taiwan's overall exports, which have been in a continuous downturn for 16 months since March 2022. The persistent interest rate hikes by the U.S. Federal Reserve is a primary driver of the global export recession, compounded by the post-COVID-19 changes in the global economic landscape. These changes include the restructuring of raw material supply chains, the U.S.-China trade tensions, and geopolitical shifts altering the existing model of global production and manufacturing bases. Additionally, future trends such as net-zero emissions, ESG requirements for businesses, and the growing influence of AI will play a crucial role in the future development of the woodworking machinery industry. Furthermore, the rise of woodworking machinery in mainland China has already impacted the global proportion of woodworking machinery exports (China's exports surpassed Taiwan's in 2008, accounting for approximately 7% of the global export proportions. By 2014, they exceeded Italy's, reaching around 18%. In 2020, China's woodworking machinery exports surpassed Germany's, and it has constituted approximately 26% of the global export proportions in 2023). Facing these various trends and challenges, the future of Taiwan's woodworking machinery industry requires strategic considerations. In addition to revisiting the suggestions made at the beginning of 2023 (1. Identifying the company’s core values and “niche markets". 2. Implementing effective "knowledge management" extended to "lean management" and "digital transformation". 3. Maintaining a mindset and concept of "continuous improvement" and "customer satisfaction"). I believe we should focus on several key developments: 1. Utilize "digital tools," such as chatGDP, for tasks like drafting development letters, press releases, meeting records, customer visits, and data consolidation. The use of digital tools can enhance the integration of "knowledge management" and reduce the workload of relevant personnel. 2. Integrating "digital marketing" with "physical exhibitions" aims to optimize the marketing processes of "pre-exhibition," "during the exhibition," and "post-exhibition" at a lower cost. While customers may feel more assured seeing physical machines at exhibitions, digital marketing can precisely promote the exhibition, connecting with potential clients and significantly reducing transaction times. 3. Being attentive to trends, policies, and information related to net-zero emissions will enable the company to respond promptly when called upon to act. 4. Addressing the challenges of Taiwan's declining birthrate and labor shortage by collaborating with the government's policies for attracting foreign talent and seeking the necessary expertise for our own companies. These are irreversible trends. Adequate preparation will better position us to adapt to the unpredictable future, and our collective pursuit should be focused on achieving "high net profit" rather than merely “high turnover."

Hanoi market: Prospects and opportunities

- 2023-12-15

In Vietnam, Hanoi ranks as high as Binh Duong municipality and Ho Chi Minh city in terms of investment opportunities for the furniture and real estate industries. Here is a brief overview of what the Hanoi furniture and construction markets have to offer.

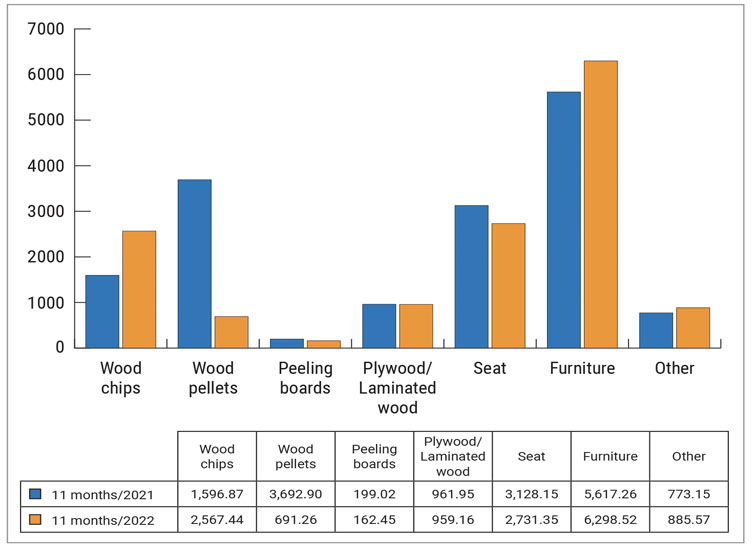

WOOD AND WOOD PRODUCTS

Hanoi produces and exports various wood and wood products, but the segments that have recorded the strongest growth thus far are wood chips, pellets, and wooden furniture, with furniture being the largest proportion in the industry, occupying as much as roughly US$6.3m in the first 11 months of 2022 (Fig. 1).*

According to data by the Fine Arts Association of Ho Chi Minh city and Handicraft and Wood Industry Association of Ho Chi Minh city (HAWA), the average consumption and demand for furniture in Vietnam is $21 per person per year.* This figure by itself might not seem much, but taking into account Hanoi’s population, which is around 8.5 million people as of early 2023* — accounting for about 8.5% of the country’s population, second highest after Ho Chi Minh city — the domestic demand for furniture can exceed over $100m annually.

Furthermore, with Hanoi’s current average population density of about 2,480 people per km2 — 8.3 times higher than the population density of the whole country, and second highest after Ho Chi Minh city, which is 4,375 people per km2 — this density should be a clear indicator of how strong the demand for furniture and furnishings can be in the near future, as Hanoi continues to grow in population.*

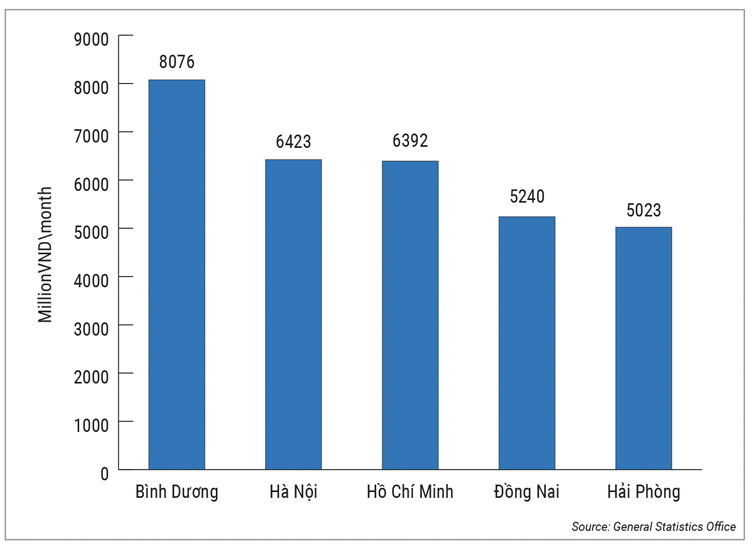

Preliminary results announced by the Population Living Standards Survey 2022 of the General Statistics Office reported that Hanoi ranks second in terms of per capital income in the country with 6,423m Vietnamese dong per person per month, while Binh Duong takes first with 8,076m Vietnamese dong per person per month (Fig. 2).* As of Q1 2023, according to the General Statistics Office, the average monthly income of employees in Q1 2023 was 7m Vietnamese dong person, an increase of 197,000 Vietnamese dong compared to the previous quarter and an increase of 640,000 Vietnamese dong over the same period last year.*

According to data by the Fine Arts Association of Ho Chi Minh city and Handicraft and Wood Industry Association of Ho Chi Minh city (HAWA), the average consumption and demand for furniture in Vietnam is $21 per person per year.* This figure by itself might not seem much, but taking into account Hanoi’s population, which is around 8.5 million people as of early 2023* — accounting for about 8.5% of the country’s population, second highest after Ho Chi Minh city — the domestic demand for furniture can exceed over $100m annually.

Furthermore, with Hanoi’s current average population density of about 2,480 people per km2 — 8.3 times higher than the population density of the whole country, and second highest after Ho Chi Minh city, which is 4,375 people per km2 — this density should be a clear indicator of how strong the demand for furniture and furnishings can be in the near future, as Hanoi continues to grow in population.*

Preliminary results announced by the Population Living Standards Survey 2022 of the General Statistics Office reported that Hanoi ranks second in terms of per capital income in the country with 6,423m Vietnamese dong per person per month, while Binh Duong takes first with 8,076m Vietnamese dong per person per month (Fig. 2).* As of Q1 2023, according to the General Statistics Office, the average monthly income of employees in Q1 2023 was 7m Vietnamese dong person, an increase of 197,000 Vietnamese dong compared to the previous quarter and an increase of 640,000 Vietnamese dong over the same period last year.*

Although per capita income is not high, the demand for high-end furniture in Vietnam is not inferior to that of Hong Kong, Singapore, or other very high-income countries. In fact, Hanoi and Ho Chi Minh city are two markets where the demand for high-end furniture products is rapidly increasing. And to meet this demand, many furniture companies, local and global, have set up in Hanoi, approximating 710; Ho Chi Minh city has the most furniture companies in Vietnam with 1,170 firms, followed by Binh Duong with 715, then Hanoi.*

REAL ESTATE MARKET

The demand for furniture is closely related to the market performance for the real estate, hospitality and construction industries, where there is a need to supply furniture and furnishings for interior and structural works.

According to Phan Dang Chuong, deputy general director of ERNST & Young Vietnam, in the past five years there have been about 400,000-500,000 townhouses and high-class apartments raised in Vietnam.* On average, each apartment uses at least 100-200m Vietnamese dong for interior furnishing and design, which means there is about 100,000bn Vietnamese dong for this particular demand.

However, Vietnam has seen a drop in commercial housing demand as of 2023. Real estate market statistics from Vietnam’s Ministry of Construction reported that commercial housing development projects in Q1 of 2023 have 14 projects with nearly 6,000 units. The number of projects is about 50% compared to Q4 of 2022 and is about more than 63% of the same period in 2022. “The supply of commercial housing in Q1 2023 is still limited and tends to decrease compared to Q4 2022,” commented the Minister of Construction.*

The Ministry of Construction further said that although the market fluctuates a lot, apartments still continue to attract the attention of the target group with real housing needs. The number of new apartment projects opened for sale in Q1 2023 is not much, mainly from the mid-range and high-end segments, concentrated in Hanoi, Ho Chi Minh city, and Binh Dinh.*

Statistics have also shown that the total transaction volume of Q1 2023 only reached more than 106,000 successful transactions, equalling about 65% compared to Q4 2022 and 61% compared to Q1 2022. In this, the number of successful transactions of land plots decreased significantly, and successful transactions of apartments and individual houses increased sharply; there were more than 39,000 successful transactions for individual houses and apartments, while land plot has more than 67,000 successful transactions.*

As for the hospitality sector, Savills Vietnam’s report said that in Q1 2023, hotel guests increased by 220% year-on-year, reaching 1.1 million arrivals, and 339,000 domestic guests increased by 21% year-on-year. The number of international visitors saw an increase of 1,400% year-on-year to 712,000, presumably after borders have reopened.* The tourism sector is making a return, which means the need to supply furniture and woodworking equipment is enhanced to meet the sharp increase in demand for hotel projects supporting the tourism industry.

Assessing the market outlook, Matthew Powell, director of Savills Hanoi, described that the Hanoi market in 2023 is expected to have two new projects with a total of 471 rooms. From 2024 onwards, there will be 66 new projects with 11,123 rooms. Of these 68 projects, the number of five-star hotels accounts for 61%.*

He added: “This is a positive addition to the hotel supply, especially luxury hotels in Hanoi. In addition, the appearance of branded apartments as well as three- to four-star hotels in the inner city and surrounding areas will help increase the diversity of existing tourism products on the market assessment.”

Source:Panels & Furniture Asia.

Although per capita income is not high, the demand for high-end furniture in Vietnam is not inferior to that of Hong Kong, Singapore, or other very high-income countries. In fact, Hanoi and Ho Chi Minh city are two markets where the demand for high-end furniture products is rapidly increasing. And to meet this demand, many furniture companies, local and global, have set up in Hanoi, approximating 710; Ho Chi Minh city has the most furniture companies in Vietnam with 1,170 firms, followed by Binh Duong with 715, then Hanoi.*

REAL ESTATE MARKET

The demand for furniture is closely related to the market performance for the real estate, hospitality and construction industries, where there is a need to supply furniture and furnishings for interior and structural works.

According to Phan Dang Chuong, deputy general director of ERNST & Young Vietnam, in the past five years there have been about 400,000-500,000 townhouses and high-class apartments raised in Vietnam.* On average, each apartment uses at least 100-200m Vietnamese dong for interior furnishing and design, which means there is about 100,000bn Vietnamese dong for this particular demand.

However, Vietnam has seen a drop in commercial housing demand as of 2023. Real estate market statistics from Vietnam’s Ministry of Construction reported that commercial housing development projects in Q1 of 2023 have 14 projects with nearly 6,000 units. The number of projects is about 50% compared to Q4 of 2022 and is about more than 63% of the same period in 2022. “The supply of commercial housing in Q1 2023 is still limited and tends to decrease compared to Q4 2022,” commented the Minister of Construction.*

The Ministry of Construction further said that although the market fluctuates a lot, apartments still continue to attract the attention of the target group with real housing needs. The number of new apartment projects opened for sale in Q1 2023 is not much, mainly from the mid-range and high-end segments, concentrated in Hanoi, Ho Chi Minh city, and Binh Dinh.*

Statistics have also shown that the total transaction volume of Q1 2023 only reached more than 106,000 successful transactions, equalling about 65% compared to Q4 2022 and 61% compared to Q1 2022. In this, the number of successful transactions of land plots decreased significantly, and successful transactions of apartments and individual houses increased sharply; there were more than 39,000 successful transactions for individual houses and apartments, while land plot has more than 67,000 successful transactions.*

As for the hospitality sector, Savills Vietnam’s report said that in Q1 2023, hotel guests increased by 220% year-on-year, reaching 1.1 million arrivals, and 339,000 domestic guests increased by 21% year-on-year. The number of international visitors saw an increase of 1,400% year-on-year to 712,000, presumably after borders have reopened.* The tourism sector is making a return, which means the need to supply furniture and woodworking equipment is enhanced to meet the sharp increase in demand for hotel projects supporting the tourism industry.

Assessing the market outlook, Matthew Powell, director of Savills Hanoi, described that the Hanoi market in 2023 is expected to have two new projects with a total of 471 rooms. From 2024 onwards, there will be 66 new projects with 11,123 rooms. Of these 68 projects, the number of five-star hotels accounts for 61%.*

He added: “This is a positive addition to the hotel supply, especially luxury hotels in Hanoi. In addition, the appearance of branded apartments as well as three- to four-star hotels in the inner city and surrounding areas will help increase the diversity of existing tourism products on the market assessment.”

Source:Panels & Furniture Asia.

Taipei Building Show grand opening on Dec 07, in Nangang Exhibition Hall

- 2023-12-07

The "35th Taipei Building Show was held grandly on December 7, using the first and fourth floors of Hall 1 of the Nangang Exhibition Hall. Louquan District is the largest, most international and professional construction and building materials exhibition in Taiwan. The "52nd Architects' Day Celebration Conference" and the "20th Taiwan Architecture Forum" will be held simultaneously during the exhibition, which will attract architectural professionals, designers, manufacturers, suppliers, traders and the public from all over the world. Expect great things.

.jpg)

.jpg) The exhibition is divided into nine areas based on product attributes, namely "Doors, Windows and Hardware and Building Materials Area", "Green Building Green Building Materials Area", "Smart Building Area", "Comprehensive Building Materials Area", "Furniture and Decoration Area", "Bathroom Ware" Kitchenware Area", "Lighting Area", "Floor, Wall Materials and Decorative Building Materials Area" and "Overseas Exhibition Area", in addition to domestic high-quality building materials related companies, there are also exhibitors from the United States, Spain, Japan, Thailand, Singapore, China, and Malaysia. Nine countries including China, Indonesia and South Korea participated in the exhibition, as well as many international distribution agents. Nearly 500 exhibitors used more than 2,300 booths to display the latest and highest quality building materials products and construction methods and technologies from all over the world.

The exhibition is divided into nine areas based on product attributes, namely "Doors, Windows and Hardware and Building Materials Area", "Green Building Green Building Materials Area", "Smart Building Area", "Comprehensive Building Materials Area", "Furniture and Decoration Area", "Bathroom Ware" Kitchenware Area", "Lighting Area", "Floor, Wall Materials and Decorative Building Materials Area" and "Overseas Exhibition Area", in addition to domestic high-quality building materials related companies, there are also exhibitors from the United States, Spain, Japan, Thailand, Singapore, China, and Malaysia. Nine countries including China, Indonesia and South Korea participated in the exhibition, as well as many international distribution agents. Nearly 500 exhibitors used more than 2,300 booths to display the latest and highest quality building materials products and construction methods and technologies from all over the world.

.jpg)

LIGNA with new event dates from 2027 onwards

- 2023-12-07

Hannover. From 2027, LIGNA will be setting a new strategic course in terms of dates. It will leave the usual event period over Ascension Day and from 2027 onwards will continue to be held in the odd-numbered years – but detached from the public holiday – in spring in Hanover, Germany. This was a joint decision by the LIGNA organizers, Deutsche Messe AG and VDMA Woodworking Machinery after intensive discussions. LIGNA 2027 will be held in Hanover from Monday, May 10 to Friday, May 14, and LIGNA 2029 from Monday, May 14 to Friday, May 18. The date of LIGNA 2025 over Ascension Day from Monday, May 26 to Friday, May 30 remains unchanged. Stephanie Wagner, Head of LIGNA, Deutsche Messe AG: “The decisive factor for LIGNA’s rescheduling from 2027 is the change in visitor behavior on Ascension Day and the following Friday as a bridge day.” A look at LIGNA's history shows that the trade fair was originally deliberately scheduled for Ascension Day week. The visitor focus on the public holiday was particularly on the skilled trades sector. “The leisure behavior of visitors has changed significantly in recent years. Thursday as a national public holiday and the following Friday as a bridge day are very popular as an extended vacation weekend, particularly by German visitors from the skilled trades sector, but also from the industry. Our visitor analyses clearly confirm this. As the world's leading trade fair for the woodworking and wood processing industry, we want to present our exhibiting companies with a high quality and quantity of national and international visitors on all five days of the fair – from all visitor target groups. From our perspective, this will only be possible if LIGNA leaves the Ascension week in future,” explains Wagner. VDMA Woodworking Machinery considers a new event period for LIGNA from 2027 onwards to be of fundamental importance. Dr. Bernhard Dirr, Managing Director VDMA Woodworking Machinery, Frankfurt am Main: “Efficiency is the key to a successful trade fair these days, and that applies to exhibitors and visitors alike. Time at a trade fair is valuable and needs to be used optimally. This is best achieved when the number of visitors is spread as evenly as possible over all days. This is exactly what the new LIGNA date ensures.” Making even greater use of international visitor synergies with interzum in Cologne When rescheduling a world-leading trade fair such as LIGNA, many different aspects and complex interrelationships have to be evaluated and taken into account. Especially with regard to the international LIGNA visitors from overseas, the proximity of dates to interzum in Cologne is a factor. The two trade fairs are traditionally held close to each other and together attract international visitors overseas, for example. And it is precisely these visitors who benefit from the proximity of the two thematically complementary trade fairs when planning their travel and visits. Stephanie Wagner: “We are scheduling LIGNA 2027 before interzum. From 2029, LIGNA will then run parallel to interzum. By taking this step, we will enable all visitors to visit both trade fairs in a balanced and time-efficient manner and thus contribute to the average length of stay of an international visitor at European trade fairs, which according to our analyses is around 2.5 days.” LIGNA dates 2025 to 2029 at a glance: LIGNA 2025: Monday, May 26 to Friday, May 30 in Hanover (unchanged). LIGNA 2027: Monday, May 10 to Friday, May 14 in Hanover (new). LIGNA 2029: Monday, May 14 to Friday, May 18 in Hanover (new). About LIGNA The world’s leading trade fair for the woodworking and wood processing industry is jointly organized by Deutsche Messe and VDMA Woodworking Machinery. It showcases the entire range of products and services for the primary and secondary industries – tools, machines and systems for custom and mass production, surface technology, wood-based panel production, sawmill technology, energy from wood, machine components and automation technology, as well as machines and systems for forestry technology. Source :LIGNA