AN EXCELLENT 2023 AND MANY NEW PROJECTS FOR 2024

- 2024-01-26

“We are optimistic: there will always be room for companies that offer smart and effective solutions through an international network”. This is the comment of both Stefano and Riccardo Mauri – owners of Giardina Group, a world leader in painting and surface finishing technologies – regarding the 2023 results. Seventy employees, a turnover of around 20 million euros, a vast range of solutions stemming from a long-lasting and well-established partnership with companies that – in every corner of the world – operate in the painting sector, deep relationships that have enabled the Italian company to reach an export share close to 95% of its total output. A consolidated presence in many international markets that has made it possible to acquire an extensive set of orders for 2024 as well: indeed, after a brief period of uncertainty, demand has returned to good levels, with the possibility of planning key deliveries up to the beginning of 2025, so as to have the energy needed to include any urgent requests in production programmes. Precisely the ability to respond quickly to customer requests is one of the keys to the growing success of Giardina Group. Its production focuses precisely on this aspect, as the order for a machine or system is not always something planned and the above often proves to be a strategic tool for tackling certain orders. This strategy includes the availability of stand-alone machines that can be installed and tested in a few weeks, so as to help clients be more competitive. On the other hand, 2023 saw the confirmation of Giardina Group's vocation for custom-made systems. This has always been the core business of the company, which continues to be among the privileged partners for this type of demand, thanks to an even more direct involvement in phases part of the painting process: handling and sanding. “We are building an actual network also at a technical-production level, thanks to which we can also offer edge and profile sanding solutions to those who want our quality, thanks to Destefani, but also automation, logistics and handling solutions”, says Riccardo Mauri, co-owner and technical director at Giardina Group. “Offering technology involves full attention to the customer's needs, as well as to the big issues that the industry must be able to responsibly address today. There is much talk about sustainability, for example, a topic that has always been a daily challenge for a sector like ours. Painting-related activities have alarmed, often rightly, many. The situation is very different today and we, as technology manufacturers, are the first to implement a whole series of innovations and solutions which not only comply with the most stringent environmental protection regulations, but also regulations that guarantee aesthetic quality and resistance that are even better than in the past. Right from the early design stages, each machine, each system is studied and defined so that it has the lowest possible energy requirements and very low emission levels, whilst always guaranteeing finishes of the best quality”. “Skills and quality that we show at work in our Giampiero Mauri Innovation Centre, a laboratory/show room where technicians and customers from all over the world come to test their products, to paint them, to verify the quality that our machines and our systems can help provide”, says sales director Stefano Tibè. “We are launching new integrated hospitality projects for customers, offering an increasingly broader range of demos and training on every aspect of finishing, for which we receive many participation requests every year. Besides, we have all realized that now it is not enough to design and build good machines, but you need to provide a comprehensive, total service that enables customers to exclusively focus on their own business, delegating all the issues related to the various processing cycles to trusted suppliers”. Therefore, companies that do not limit themselves to manufacturing, but that constantly interact with all the players in the supply chain, becoming bearers of ideas and values: it is no coincidence that the Giardina Group Academy will be launched in 2024. This is meant to be an actual ‘school’ that will be carried out in partnership with Catas, the most important testing laboratory for the wood and furniture supply chain in Europe. It will start out in Brazil, a country that is proving to be increasingly strategic for Giardina Group. “We want to prove that sharing knowledge can open new avenues in markets where there is still a lot to discover”; added Stefano Mauri. “An initiative that has been in our plans for some time and which we want to turn into an actual model to export to other countries, because Italian technology must increasingly act as a complex response, in which the machine is only one of the components necessary to guarantee a service. This is what businesses want today: service, the ability to have tools that are easy to use, supported by actual partners not only at the time of sale, but also and above all at the assistance stage, in continuity with the relationship established, with hardware and software updates acting as a support to accept new orders and redefine competitiveness levels on a market clearly constantly on the move. This all leads us to face this economic season with peace of mind. A season in many ways influenced by excellent results in terms of turnover but also by greater uncertainties in terms of orders. We find ourselves operating in an economic-social context full of complexity that we recommend many stand back and watch for a little while longer, waiting for at least some of the many clouds that still darken the horizon to disappear”. A chapter that underlines with a precise strategy the commitment of Giardina Group in markets all over the world. It enabled the company to consolidate a strong network of stable representatives to reiterate a ‘quality proximity’ to its increasingly numerous customers. Giardina Group in a nutshell Seventy employees, a turnover of around 20 million euros, an export share of close to 95% and know-how that has resulted in an extremely comprehensive catalogue: from beam impregnation to the treatment of ‘Jumbo’ glass sheets, from profile finishing to sophisticated robot systems for coating windows and doors or furniture building materials. Today Giardina Group stands for design, development and manufacture of machines and full coating systems (roller, film, spray and vacuum); automated and robotic lines with hot air, UV or microwave drying systems; overhead lines to coat windows and doors or three-dimensional pieces, spray booths and special systems and – with Destefani – edge and profile sanding solutions.

New SCM subsidiary in Slovenia

- 2024-01-16

The launch of this new subsidiary is aimed at providing a direct, punctual and highly specialised sales and service support to woodworking businesses

in Slovenia and Serbia. The SCM team will also work in sync with dealers in Croatia and Bosnia and will be a benchmark for the entire Balkans area.

SCM continues making investments to guarantee a capillary and direct presence in the most strategic international markets.

This mission is met with the opening of a new SCM subsidiary in January 2024, based in Trzin, near Ljubljana in Slovenia. It is being opened to directly follow clients in both the Slovenian and Serbian markets, preserving their local characteristics and identities. In addition, it will work alongside and provide even more efficient support to the dealers already operating in Croatia and Bosnia.

The new subsidiary, SCM’s first in the Balkans, will become a benchmark for the entire region where, for a number of years now, the wood-furnishing industry has recorded a more than positive trend and includes businesses that are increasingly technologically advanced.

The facility will have an exclusive 1,500 square metre Technology Center offering a wide and varied range of the latest SCM innovations, with machinery and services strongly in line with the production requirements of this market.

SCM will also be able to rely on a team of technicians and sales engineers who are highly specialised in all the application fields of secondary wood processing: from the joinery workshop to large furniture industries, right up to windows and doors and timber construction which is recording strong and continuous growth throughout the region.

Being able to interact directly with the SCM team also means taking a closer look at, and selecting from, an exclusive offer of technologies and software which represents the widest range of wood processing solutions internationally.

There are also considerable advantages for customer care: the client can take advantage of more punctual after-sales support both with regard to technical maintenance and management of spare parts, as well as having rapid access to the numerous digital services enabled by SCM’s IoT platform, Maestro connect for an ever more efficient proactive and predictive assistance.

“With the opening of this new branch, businesses in the industry will benefit from an all-round commercial and technical partnership - says Lorenzo Trolese, SCM Country Manager for Balkans area -. Our team, which will continue to grow, even in the coming months, with the addition of new sales and services resources, can provide the client with all the support, consulting and training needed to optimise its production processes. This represents a huge leap in quality for this market because it can continue along a direct line and an ever more efficient and direct service, from pre to post sales”.

Source: SCM Group

Source: SCM Group

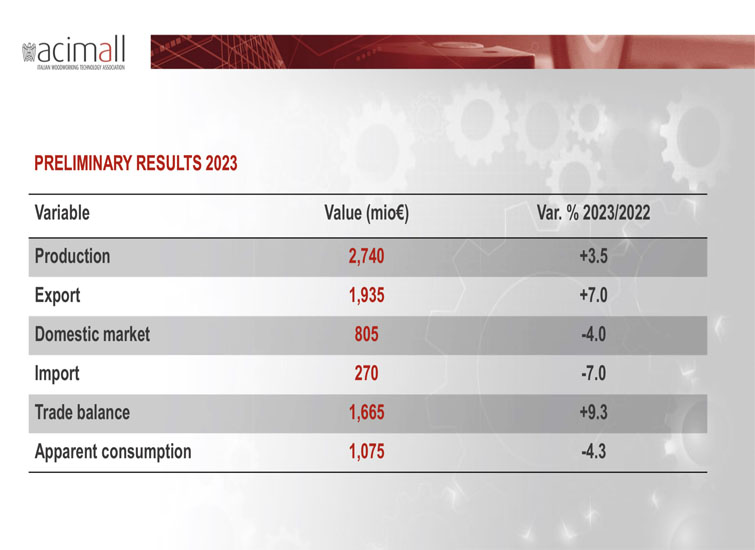

TECHNOLOGY FOR WOODWORKING AND THE FURNITURE INDUSTRY: ANOTHER POSITIVE YEAR IN 2023 (plus 3.5 percent)

- 2024-01-11

The preliminary balance of 2023 drafted by the Studies Office of Acimall shows 3.5 percent growth of production compared to 2022. So, despite a trend of orders that was much less satisfactory than the excellent results of the past years, the companies had and still have a strong order backlog, allowing them to increase their revenues also in the year that’s going to end. After the 5.3 percent increase achieved in 2022 over the record year 2021, this trend indicates the full health of the industry companies, who had the opportunity to invest and strengthen their position in Italy and, according to tradition, all over the world. The value of production reached up to 2.74 billion euro, net of inflation, but still an all-time record for the woodworking machinery industry in a period when all mechanical industry domains, machine tools above all, are experiencing the same situation. Export – which account for approximately 70 percent of total revenues – increased by 7 percent (1.935 billion euro in value), while sales on the domestic market are falling (805 million, down by 4 percent from 2022), also reflected by the significant decrease in import (270 million in value, minus 7 percent compared to the previous year). The Italian market is going through a less positive period and it could not be otherwise, considering that the investments made by users in recent years have reached significant levels, actually saturating the equipment fleets. Therefore, the reduction is natural and expected, and it must be evaluated accordingly. The reduction of apparent consumption amounted to 4.3 percent, down to 1.075 billion euro, showing the consistently strong demand of wood and furniture technology in Italy, which remains the fourth global market after China, the United States and Germany, and before Vietnam at number five. It is also worth noticing that, also in 2023, the industry of wood and wood-based material technology maintained an excellent performance in terms of trade balance, with an active result by 1.665 billion euro, 9.3 percent higher than in 2022; this is definitely one of the most significant results in the entire landscape of machine tools and a great contribution to the total Italian result. THE YEAR 2024 As mentioned, for a few quarters now, the woodworking machinery industry has moved back to more “normal” values, after the booming trend of recent years, and it is expected to follow the same trend also in 2024. “Such values can hardly be estimated today, due to the tragic international events we all know, that might have a heavy impact on the global economy”, said Acimall’s director Dario Corbetta. “Our industry is also subject to ups and downs, with positive periods alternating with less satisfactory ones: the news – so to say – is that the growth in the past years was so powerful to generate a peak, a strong discontinuity that will require a slow return to normal, hence the persistence of negative values over a long time, though with lower rates”. “However, there is a feeling that the industry is worrying excessively for what can be considered a natural slowdown”, Corbetta continued. “2023 figures are showing this, and today, the companies are definitely much stronger in terms of financial capacity and organization, compared to previous, much more difficult periods: as a result, they will be able to face a business reduction that we can call “normal”, though apparently magnified by the extraordinary results of the previous three years”. INDUSTRY 5.0 Undoubtedly, in recent years, the Italian market has been “stimulated” by measures that encouraged different types of investments. And also for the next season, there are variables that might affect the results to a significant extent. We are referring to measures included in the “Industry 5.0” plan, within the framework of the national recovery and resilience plan (Pnrr), approved by the European Commission as consistent with the “REPower EU” plan, aimed at accelerating the transition of EU countries to clean power , and more generally, at the adoption of energy-saving measures. The new facilitations introduced by Italian financial institutions fit into this context, supporting investments that meet the standards of connectivity and integration into the enterprise management networks envisaged by “Industry 4.0”, and ensuring less power-hungry operations in addition. “For the 2024-2025 period, companies will have access to tax credits for a total value of 6.3 billion euro, to be added to the benefits of “Industria 4.0”, a plan created to support all measures for the energy efficiency of machines and plants”, Dario Corbetta said. “The shrinkage of recent months might have been driven by many companies which decided to wait for the full deployment of the new measure before making new investments. Saying that such measures are “appreciated” is a clear understatement, despite their “elastic” effect on demand. Longer-term policies that do not overlap year after year would certainly have more enduring and structural effects on demand trends”. There are elements for cautious optimism, and for sure, Xylexpo 2024 – the biennial international exhibition of technology for the wood supply chain organized by Acimall to be held at FieraMilano-Rho next May 21 to 24 – comes right on time to help potential customers and users leverage the innovation in terms of energy efficiency that will characterize the entire portfolio. Source:ACIMALL

“High turnover.

- 2024-01-04

We were honored to interview Joe Chang , the chairman of TWMA to share and his thoughts on the future of woodworking machinery in 2024. The key points here are as follows: In the years 2020 and 2021, Taiwan's woodworking machinery industry experienced a compound growth of 54%. However, the period from 2022 to 2023, there was a significant compound decline of nearly 70%. This decline is not limited to the woodworking machinery industry but extends to Taiwan's overall exports, which have been in a continuous downturn for 16 months since March 2022. The persistent interest rate hikes by the U.S. Federal Reserve is a primary driver of the global export recession, compounded by the post-COVID-19 changes in the global economic landscape. These changes include the restructuring of raw material supply chains, the U.S.-China trade tensions, and geopolitical shifts altering the existing model of global production and manufacturing bases. Additionally, future trends such as net-zero emissions, ESG requirements for businesses, and the growing influence of AI will play a crucial role in the future development of the woodworking machinery industry. Furthermore, the rise of woodworking machinery in mainland China has already impacted the global proportion of woodworking machinery exports (China's exports surpassed Taiwan's in 2008, accounting for approximately 7% of the global export proportions. By 2014, they exceeded Italy's, reaching around 18%. In 2020, China's woodworking machinery exports surpassed Germany's, and it has constituted approximately 26% of the global export proportions in 2023). Facing these various trends and challenges, the future of Taiwan's woodworking machinery industry requires strategic considerations. In addition to revisiting the suggestions made at the beginning of 2023 (1. Identifying the company’s core values and “niche markets". 2. Implementing effective "knowledge management" extended to "lean management" and "digital transformation". 3. Maintaining a mindset and concept of "continuous improvement" and "customer satisfaction"). I believe we should focus on several key developments: 1. Utilize "digital tools," such as chatGDP, for tasks like drafting development letters, press releases, meeting records, customer visits, and data consolidation. The use of digital tools can enhance the integration of "knowledge management" and reduce the workload of relevant personnel. 2. Integrating "digital marketing" with "physical exhibitions" aims to optimize the marketing processes of "pre-exhibition," "during the exhibition," and "post-exhibition" at a lower cost. While customers may feel more assured seeing physical machines at exhibitions, digital marketing can precisely promote the exhibition, connecting with potential clients and significantly reducing transaction times. 3. Being attentive to trends, policies, and information related to net-zero emissions will enable the company to respond promptly when called upon to act. 4. Addressing the challenges of Taiwan's declining birthrate and labor shortage by collaborating with the government's policies for attracting foreign talent and seeking the necessary expertise for our own companies. These are irreversible trends. Adequate preparation will better position us to adapt to the unpredictable future, and our collective pursuit should be focused on achieving "high net profit" rather than merely “high turnover."

Hanoi market: Prospects and opportunities

- 2023-12-15

In Vietnam, Hanoi ranks as high as Binh Duong municipality and Ho Chi Minh city in terms of investment opportunities for the furniture and real estate industries. Here is a brief overview of what the Hanoi furniture and construction markets have to offer.

WOOD AND WOOD PRODUCTS

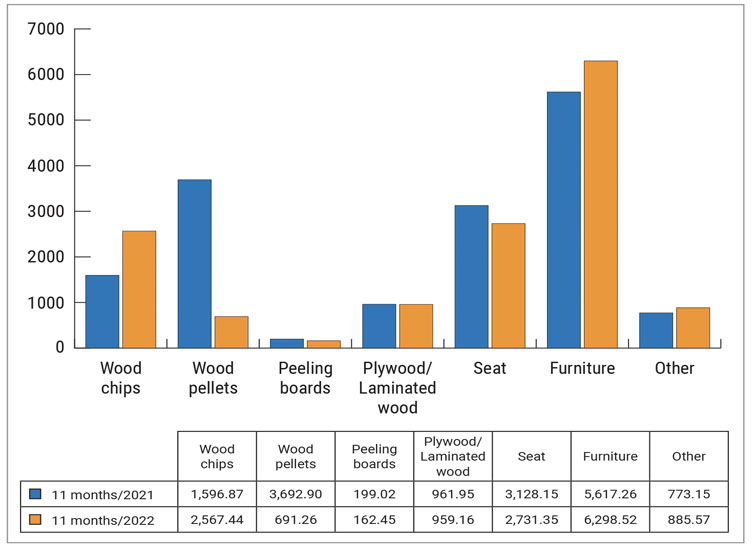

Hanoi produces and exports various wood and wood products, but the segments that have recorded the strongest growth thus far are wood chips, pellets, and wooden furniture, with furniture being the largest proportion in the industry, occupying as much as roughly US$6.3m in the first 11 months of 2022 (Fig. 1).*

According to data by the Fine Arts Association of Ho Chi Minh city and Handicraft and Wood Industry Association of Ho Chi Minh city (HAWA), the average consumption and demand for furniture in Vietnam is $21 per person per year.* This figure by itself might not seem much, but taking into account Hanoi’s population, which is around 8.5 million people as of early 2023* — accounting for about 8.5% of the country’s population, second highest after Ho Chi Minh city — the domestic demand for furniture can exceed over $100m annually.

Furthermore, with Hanoi’s current average population density of about 2,480 people per km2 — 8.3 times higher than the population density of the whole country, and second highest after Ho Chi Minh city, which is 4,375 people per km2 — this density should be a clear indicator of how strong the demand for furniture and furnishings can be in the near future, as Hanoi continues to grow in population.*

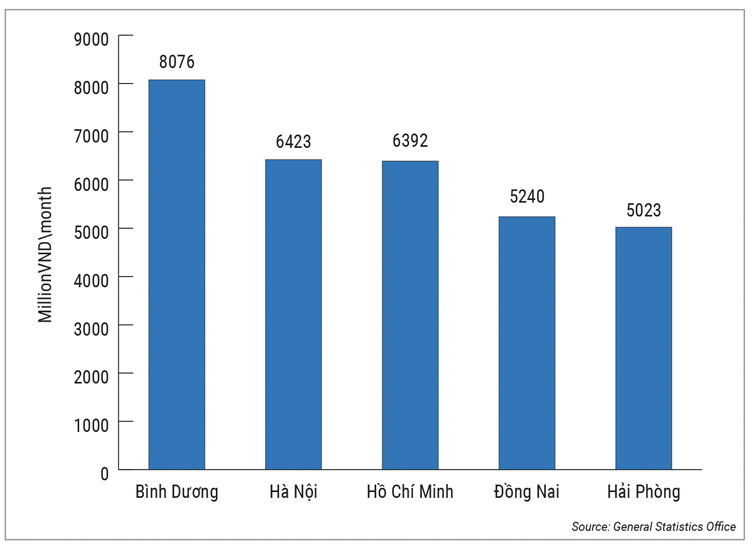

Preliminary results announced by the Population Living Standards Survey 2022 of the General Statistics Office reported that Hanoi ranks second in terms of per capital income in the country with 6,423m Vietnamese dong per person per month, while Binh Duong takes first with 8,076m Vietnamese dong per person per month (Fig. 2).* As of Q1 2023, according to the General Statistics Office, the average monthly income of employees in Q1 2023 was 7m Vietnamese dong person, an increase of 197,000 Vietnamese dong compared to the previous quarter and an increase of 640,000 Vietnamese dong over the same period last year.*

According to data by the Fine Arts Association of Ho Chi Minh city and Handicraft and Wood Industry Association of Ho Chi Minh city (HAWA), the average consumption and demand for furniture in Vietnam is $21 per person per year.* This figure by itself might not seem much, but taking into account Hanoi’s population, which is around 8.5 million people as of early 2023* — accounting for about 8.5% of the country’s population, second highest after Ho Chi Minh city — the domestic demand for furniture can exceed over $100m annually.

Furthermore, with Hanoi’s current average population density of about 2,480 people per km2 — 8.3 times higher than the population density of the whole country, and second highest after Ho Chi Minh city, which is 4,375 people per km2 — this density should be a clear indicator of how strong the demand for furniture and furnishings can be in the near future, as Hanoi continues to grow in population.*

Preliminary results announced by the Population Living Standards Survey 2022 of the General Statistics Office reported that Hanoi ranks second in terms of per capital income in the country with 6,423m Vietnamese dong per person per month, while Binh Duong takes first with 8,076m Vietnamese dong per person per month (Fig. 2).* As of Q1 2023, according to the General Statistics Office, the average monthly income of employees in Q1 2023 was 7m Vietnamese dong person, an increase of 197,000 Vietnamese dong compared to the previous quarter and an increase of 640,000 Vietnamese dong over the same period last year.*

Although per capita income is not high, the demand for high-end furniture in Vietnam is not inferior to that of Hong Kong, Singapore, or other very high-income countries. In fact, Hanoi and Ho Chi Minh city are two markets where the demand for high-end furniture products is rapidly increasing. And to meet this demand, many furniture companies, local and global, have set up in Hanoi, approximating 710; Ho Chi Minh city has the most furniture companies in Vietnam with 1,170 firms, followed by Binh Duong with 715, then Hanoi.*

REAL ESTATE MARKET

The demand for furniture is closely related to the market performance for the real estate, hospitality and construction industries, where there is a need to supply furniture and furnishings for interior and structural works.

According to Phan Dang Chuong, deputy general director of ERNST & Young Vietnam, in the past five years there have been about 400,000-500,000 townhouses and high-class apartments raised in Vietnam.* On average, each apartment uses at least 100-200m Vietnamese dong for interior furnishing and design, which means there is about 100,000bn Vietnamese dong for this particular demand.

However, Vietnam has seen a drop in commercial housing demand as of 2023. Real estate market statistics from Vietnam’s Ministry of Construction reported that commercial housing development projects in Q1 of 2023 have 14 projects with nearly 6,000 units. The number of projects is about 50% compared to Q4 of 2022 and is about more than 63% of the same period in 2022. “The supply of commercial housing in Q1 2023 is still limited and tends to decrease compared to Q4 2022,” commented the Minister of Construction.*

The Ministry of Construction further said that although the market fluctuates a lot, apartments still continue to attract the attention of the target group with real housing needs. The number of new apartment projects opened for sale in Q1 2023 is not much, mainly from the mid-range and high-end segments, concentrated in Hanoi, Ho Chi Minh city, and Binh Dinh.*

Statistics have also shown that the total transaction volume of Q1 2023 only reached more than 106,000 successful transactions, equalling about 65% compared to Q4 2022 and 61% compared to Q1 2022. In this, the number of successful transactions of land plots decreased significantly, and successful transactions of apartments and individual houses increased sharply; there were more than 39,000 successful transactions for individual houses and apartments, while land plot has more than 67,000 successful transactions.*

As for the hospitality sector, Savills Vietnam’s report said that in Q1 2023, hotel guests increased by 220% year-on-year, reaching 1.1 million arrivals, and 339,000 domestic guests increased by 21% year-on-year. The number of international visitors saw an increase of 1,400% year-on-year to 712,000, presumably after borders have reopened.* The tourism sector is making a return, which means the need to supply furniture and woodworking equipment is enhanced to meet the sharp increase in demand for hotel projects supporting the tourism industry.

Assessing the market outlook, Matthew Powell, director of Savills Hanoi, described that the Hanoi market in 2023 is expected to have two new projects with a total of 471 rooms. From 2024 onwards, there will be 66 new projects with 11,123 rooms. Of these 68 projects, the number of five-star hotels accounts for 61%.*

He added: “This is a positive addition to the hotel supply, especially luxury hotels in Hanoi. In addition, the appearance of branded apartments as well as three- to four-star hotels in the inner city and surrounding areas will help increase the diversity of existing tourism products on the market assessment.”

Source:Panels & Furniture Asia.

Although per capita income is not high, the demand for high-end furniture in Vietnam is not inferior to that of Hong Kong, Singapore, or other very high-income countries. In fact, Hanoi and Ho Chi Minh city are two markets where the demand for high-end furniture products is rapidly increasing. And to meet this demand, many furniture companies, local and global, have set up in Hanoi, approximating 710; Ho Chi Minh city has the most furniture companies in Vietnam with 1,170 firms, followed by Binh Duong with 715, then Hanoi.*

REAL ESTATE MARKET

The demand for furniture is closely related to the market performance for the real estate, hospitality and construction industries, where there is a need to supply furniture and furnishings for interior and structural works.

According to Phan Dang Chuong, deputy general director of ERNST & Young Vietnam, in the past five years there have been about 400,000-500,000 townhouses and high-class apartments raised in Vietnam.* On average, each apartment uses at least 100-200m Vietnamese dong for interior furnishing and design, which means there is about 100,000bn Vietnamese dong for this particular demand.

However, Vietnam has seen a drop in commercial housing demand as of 2023. Real estate market statistics from Vietnam’s Ministry of Construction reported that commercial housing development projects in Q1 of 2023 have 14 projects with nearly 6,000 units. The number of projects is about 50% compared to Q4 of 2022 and is about more than 63% of the same period in 2022. “The supply of commercial housing in Q1 2023 is still limited and tends to decrease compared to Q4 2022,” commented the Minister of Construction.*

The Ministry of Construction further said that although the market fluctuates a lot, apartments still continue to attract the attention of the target group with real housing needs. The number of new apartment projects opened for sale in Q1 2023 is not much, mainly from the mid-range and high-end segments, concentrated in Hanoi, Ho Chi Minh city, and Binh Dinh.*

Statistics have also shown that the total transaction volume of Q1 2023 only reached more than 106,000 successful transactions, equalling about 65% compared to Q4 2022 and 61% compared to Q1 2022. In this, the number of successful transactions of land plots decreased significantly, and successful transactions of apartments and individual houses increased sharply; there were more than 39,000 successful transactions for individual houses and apartments, while land plot has more than 67,000 successful transactions.*

As for the hospitality sector, Savills Vietnam’s report said that in Q1 2023, hotel guests increased by 220% year-on-year, reaching 1.1 million arrivals, and 339,000 domestic guests increased by 21% year-on-year. The number of international visitors saw an increase of 1,400% year-on-year to 712,000, presumably after borders have reopened.* The tourism sector is making a return, which means the need to supply furniture and woodworking equipment is enhanced to meet the sharp increase in demand for hotel projects supporting the tourism industry.

Assessing the market outlook, Matthew Powell, director of Savills Hanoi, described that the Hanoi market in 2023 is expected to have two new projects with a total of 471 rooms. From 2024 onwards, there will be 66 new projects with 11,123 rooms. Of these 68 projects, the number of five-star hotels accounts for 61%.*

He added: “This is a positive addition to the hotel supply, especially luxury hotels in Hanoi. In addition, the appearance of branded apartments as well as three- to four-star hotels in the inner city and surrounding areas will help increase the diversity of existing tourism products on the market assessment.”

Source:Panels & Furniture Asia.

Taiwan's woodworking machinery exports are overly concentrated in a single market, with a 40% decline in the first three quarters of 2023

- 2023-11-25

According to the report of Taiwan Institute of Economic Research, top five Taiwan woodworking machinery exporting countries are the United States, China, Canada, Australia and Japan from January to September 2023.

.jpg) Due to the impact of the U.S. Federal Reserve's strong interest rate hike, the local real estate boom has declined, and my country's woodworking machinery export market has been overly concentrated in the United States, resulting in an annual decline of more than 40% in the value of my country's woodworking machinery exports from January to September 2023.

It can be found from the chart that compared with the same period last year, the total export volume which fell by 40.93%, the top four exporting countries include the United States, which fell by 40.93%, China fell by 30.78%, Canada fell by 23.64%, Australia fell by 24.55%, all fell by more than 20 percentage points, and only Italy rose by 24.38%.

Due to the impact of the U.S. Federal Reserve's strong interest rate hike, the local real estate boom has declined, and my country's woodworking machinery export market has been overly concentrated in the United States, resulting in an annual decline of more than 40% in the value of my country's woodworking machinery exports from January to September 2023.

It can be found from the chart that compared with the same period last year, the total export volume which fell by 40.93%, the top four exporting countries include the United States, which fell by 40.93%, China fell by 30.78%, Canada fell by 23.64%, Australia fell by 24.55%, all fell by more than 20 percentage points, and only Italy rose by 24.38%.

.jpg)