Universal Design, Home Storage Design Trends for the Elderly

- 2024-04-15

Taiwan has entered an aging society. Reports indicate that in 2022, the number of elderly people living alone reached nearly 530,000, doubling over the past decade. As we enter an aging society, our community infrastructure and housing need to be upgraded simultaneously. Architects and interior designers should consider these details when planning new developments or public facilities to meet the future needs of residents.

Kithen and Cabinet Association Union of Taiwan invited Ms. Connie Yang , the Chief Operating Officer of He Yi Life Co., Ltd., to deliver an insightful speech on "Universal Design: Home Storage for the Elderly" on April 9th. Chairman Mr.Jeff Chen is particularly grateful to Director Yang for taking the time to provide the key points in the design of home storage for the elderly. After the lecture, a test will be conducted. Those who pass the test will be awarded the "Senior Living Space Storage Specialist" certificate. He also hopes that member manufacturers will not only obtain relevant majors but also be able to It is of substantial benefit to its company’s operations

.jpg)

The key points are summarized as follows:

.jpg) Universal design, founded by American designer Dr. Ronald L. Mace in 1980, is a doctrine that emphasizes inclusivity in design, originating from Dr. Mace's personal experience as a person with disabilities. He outlined seven design principles:

Equitable use

Universal design, founded by American designer Dr. Ronald L. Mace in 1980, is a doctrine that emphasizes inclusivity in design, originating from Dr. Mace's personal experience as a person with disabilities. He outlined seven design principles:

Equitable useFlexibility in use

Simple and intuitive use

Perceptible information

Tolerance for error

Low physical effort

Size and space for approach and use

These principles are applicable to the general public and have become crucial design principles for designers. Home storage is closely related to home design. When designing a project, consideration must be given to the age, gender, and living arrangements of the users. Details such as brightness, voltage settings for electrical appliances such as electric beds, and bathroom space planning should be incorporated from the outset. Cleaning, organizing, and storage: Cleaning refers to keeping the environment clean.

Organizing means arranging items neatly.

Storage involves systematic and logical organization of items.

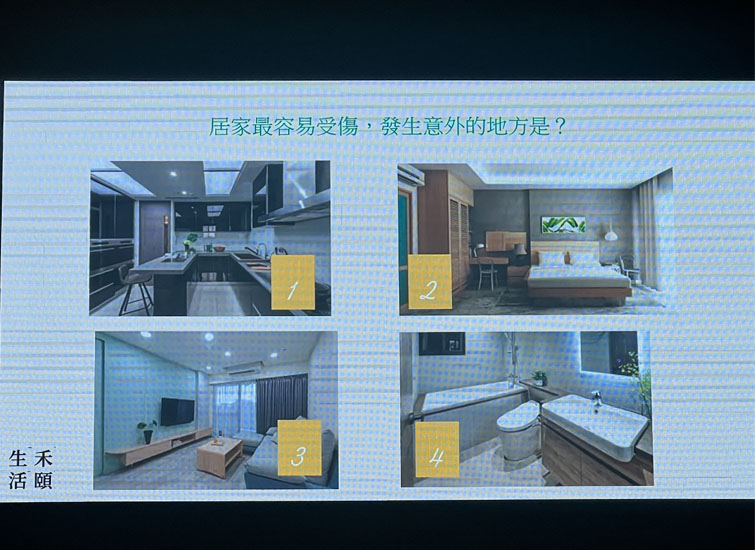

Most vulnerable areas in the home: Kitchen

Bedroom

Living room

Bathroom

Common accidents in the kitchen include burns, cuts, and falls. Therefore, safety in cooking and design of the sink area, countertop, and cooking area are crucial. Additionally, ergonomic cabinet door handles and easy-to-reach storage solutions are important. For the bedroom, safety considerations include planned movement pathways, fall prevention, adequate lighting, power outlets, caregiver space, visible storage, and ease of use. In the living room, safety measures, lighting, remote-controlled lighting, caregiver space, visible storage, and clear labeling of storage spaces are essential. Bathroom design should focus on wet and dry separation, use of partitions or curtains, and safety equipment like bathtub aids and slip-resistant flooring. In conclusion, when organizing storage in elderly homes, attention should be paid to cleaning, organization, accessibility, safety, simplicity in design, use of assistive tools, and regular inspections. With these basic design concepts and storage techniques, elderly home organization can be made easier and more efficient. Aging should not be feared, and with proper planning and preparation, aging in place is achievable, making nursing facilities not the only option for every elderly person. With thoughtful home design and preparations made in advance, aging in place can become a reality.

Rejuvenation of an Old House

- 2024-04-12

Congratulations to designer Hiseh has won the Bronze Arch Design Award in the Interior Design Catagory in Finland. The following is the designer’s experience sharing this design:

In this renovation project of a detached old house, we witness the transformation of an outdated residence into a home that is not only safe but also brimming with modern appeal through careful design and renovation. Initially, structural fortifications were made to ensure the safety of the inhabitants. Subsequently, the interior flow was redesigned by the architect to align with contemporary living requirements. By remodeling the first floor into an open-plan kitchen and integrating the living and dining areas, the home was made to appear more spacious, thus significantly enhancing its practicality and comfort.

.jpg) To further emphasize comfort and energy efficiency, the design cleverly utilizes louvers and Roman shades to regulate the introduction of natural light and to enhance ventilation. This not only improves the comfort of the living space but also helps reduce reliance on and unnecessary waste of energy. The choice of materials, combining natural wood tones with modern metal elements, creates a living space that is both sleek and cozy. In addition, the modernization of kitchen and bathroom facilities, along with the installation of an energy-saving lighting system, not only enhances the functionality of the home but also makes daily life more convenient.

To further emphasize comfort and energy efficiency, the design cleverly utilizes louvers and Roman shades to regulate the introduction of natural light and to enhance ventilation. This not only improves the comfort of the living space but also helps reduce reliance on and unnecessary waste of energy. The choice of materials, combining natural wood tones with modern metal elements, creates a living space that is both sleek and cozy. In addition, the modernization of kitchen and bathroom facilities, along with the installation of an energy-saving lighting system, not only enhances the functionality of the home but also makes daily life more convenient.

.jpg) Storage and sound insulation have also been greatly improved in the design. Such adjustments ensure a tidy and tranquil living space, allowing the homeowner to enjoy moments of peace amidst a busy life. The transformation of the outdoor terrace is a highlight of the renovation plan, cleverly turned into an enchanting small garden, providing residents with a perfect place to relax and enjoy nature.

Storage and sound insulation have also been greatly improved in the design. Such adjustments ensure a tidy and tranquil living space, allowing the homeowner to enjoy moments of peace amidst a busy life. The transformation of the outdoor terrace is a highlight of the renovation plan, cleverly turned into an enchanting small garden, providing residents with a perfect place to relax and enjoy nature.

.jpg)

.jpg) This renovation plan for the detached old house has resolved existing issues and, through a series of meticulous designs, has enhanced the value and living quality of the home, showcasing the endless possibilities of old house transformation.

This renovation plan for the detached old house has resolved existing issues and, through a series of meticulous designs, has enhanced the value and living quality of the home, showcasing the endless possibilities of old house transformation.

.jpg) Source : Huset Design

Source : Huset Design

HOMAG enters into strategic partnership with Luli

- 2024-04-11

Schopfloch, April 10,2024 – In the fourth quarter of 2023,HOMAG already received a major order from China.The contact with the Chinese customer Luli Wood Industry has a term of three years and covers the delivery of a comprehensive package of machines and systems for furniture production.The total value of the order is approximately EUR 90 million. The renewed strategic cooperation between HOMAG and Luli Wood Industry was formally sealed with a traditional signing ceremony, which was attended by Zhong Duzhang, Deputy General Manager of the Luli Group, and Dr. Daniel Schmitt, CEO of the HOMAG Group, as well as other representatives of both companies. “We decided to work with HOMAG again because the company offers advantages in the field of Industry 4.0, has extensive industry experience and has been active in China for more than 40 years,” Zhong Duzhang explained during the ceremony. The value added for the major order will be created in both Germany and China. HOMAG is relying on a mixture of Chinese and German teams for installation, commissioning, and service at Luli Wood Industry. “We are very pleased to have received this order. It also shows that the Chinese market is extremely dynamic and important for us,” Dr. Daniel Schmitt emphasized. Source: HOMAG Group

Navigating the Future: CIFM / interzum guangzhou 2024 Explores Sustainable Solutions and Cutting-edge Trends

- 2024-04-01

CIFM / interzum guangzhou opened to the furniture production industry today at the Canton Fair Complex with much fanfare. The 2024 edition surpassed expectations with an expansive area of 180,000 square meters, hosting over 1,300 exhibitors from 31 countries and regions. Across the exhibition halls, visitors encountered a diverse array of cutting-edge products, technologies, and applications spanning furniture woodworking machinery, hardware, interiors, and more. With over 230 renowned international brands in attendance, CIFM / interzum guangzhou reinforced its status as a beacon of innovation and a catalyst for industry advancement.

.jpg) New Chapter

Amidst this vibrant atmosphere, industry luminaries convened on the first day to engage in forward-thinking discussions about development and future trends, underscoring the dynamic energy and vitality of the sector. The kick-off ceremony of the interzum guangzhou Award and VSIL Forum, followed by the prestigious award ceremony, celebrated the achievements of 20 outstanding enterprises. Among the esteemed winners were Aydın Tekstil, CHENYU TEXTILE, DewertOkin, DIC, eMoMo, HD Hardware, Henkel, INTERPRINT, Lien A, LINAK, Lion Rock, PRINTECH KR, PT ATEJA TRITUNGGAL, REHAU, Remacro, Renolit, Schattdecor, SIGE SPA, SIMALFA® and Tianan New Material.

New Chapter

Amidst this vibrant atmosphere, industry luminaries convened on the first day to engage in forward-thinking discussions about development and future trends, underscoring the dynamic energy and vitality of the sector. The kick-off ceremony of the interzum guangzhou Award and VSIL Forum, followed by the prestigious award ceremony, celebrated the achievements of 20 outstanding enterprises. Among the esteemed winners were Aydın Tekstil, CHENYU TEXTILE, DewertOkin, DIC, eMoMo, HD Hardware, Henkel, INTERPRINT, Lien A, LINAK, Lion Rock, PRINTECH KR, PT ATEJA TRITUNGGAL, REHAU, Remacro, Renolit, Schattdecor, SIGE SPA, SIMALFA® and Tianan New Material.

.jpg) The four-day event's significance was underscored by Matthias Pollmann, Vice President of Koelnmesse GmbH, who remarked, "Celebrating its 100th anniversary in 2024, Koelnmesse is the world’s top trade fair organiser for the areas of Living, Contract and Public Spaces, with a presence in key markets worldwide. In collaboration with the China Foreign Trade Centre Group, Ltd., CIFM / interzum guangzhou has evolved into the flagship exhibition for woodworking machinery, furniture manufacturing, and interiors in Asia.”

Michiel Kruse, Managing Director of Koelnmesse (Beijing) Co., Ltd., kicked off the interzum guangzhou Award & VSIL Forum, “With the keyword 'Surpass' for the 2024 edition, we aim to leverage this diverse platform to drive product and technological innovation through events like the interzum guangzhou Award and the 'Vitality of Sustainable Innovation to Life' (VSIL) Forum, empowering sustainable development in the furniture industry and guiding global stakeholders to new heights!"

The 2024 exhibition, supported by international industry associations, further solidified its prominence as a focal point for woodworking industry attention and market dynamics. Luigi De Vito, President of EUMABOIS, affirmed, "interzum guangzhou is certainly the spot of great interest for the woodworking business. It acts as an excellent indicator on market dynamics and it is a real springboard for innovation in a wide range of product categories."

Gathering of Innovations

Beyond the discussions and accolades, the exhibition halls brimmed with innovation from leading global brands, each showcasing their latest breakthroughs and achievements. Visitors were treated to a diverse array of products, from advanced woodworking machinery to innovative hardware solutions and sustainable materials.

In Hall 11.1, SCM Group dazzled with its high-precision CNC machining centers, while HSD from Italy showcased cutting-edge five-axis heads and electric spindles.

In Hall 12.1.The Taiwan Exhibitors are TaiChan, Lih Woei ,Innovator, Kuang Yung, Sk Global,Jun Shiau,CYWWM, Chang Tjer,City Tools,Blue Steel,Chia Lung,Kuoming Licom,Shen Ko,Weipinmech,NewsWin Media etc.

The four-day event's significance was underscored by Matthias Pollmann, Vice President of Koelnmesse GmbH, who remarked, "Celebrating its 100th anniversary in 2024, Koelnmesse is the world’s top trade fair organiser for the areas of Living, Contract and Public Spaces, with a presence in key markets worldwide. In collaboration with the China Foreign Trade Centre Group, Ltd., CIFM / interzum guangzhou has evolved into the flagship exhibition for woodworking machinery, furniture manufacturing, and interiors in Asia.”

Michiel Kruse, Managing Director of Koelnmesse (Beijing) Co., Ltd., kicked off the interzum guangzhou Award & VSIL Forum, “With the keyword 'Surpass' for the 2024 edition, we aim to leverage this diverse platform to drive product and technological innovation through events like the interzum guangzhou Award and the 'Vitality of Sustainable Innovation to Life' (VSIL) Forum, empowering sustainable development in the furniture industry and guiding global stakeholders to new heights!"

The 2024 exhibition, supported by international industry associations, further solidified its prominence as a focal point for woodworking industry attention and market dynamics. Luigi De Vito, President of EUMABOIS, affirmed, "interzum guangzhou is certainly the spot of great interest for the woodworking business. It acts as an excellent indicator on market dynamics and it is a real springboard for innovation in a wide range of product categories."

Gathering of Innovations

Beyond the discussions and accolades, the exhibition halls brimmed with innovation from leading global brands, each showcasing their latest breakthroughs and achievements. Visitors were treated to a diverse array of products, from advanced woodworking machinery to innovative hardware solutions and sustainable materials.

In Hall 11.1, SCM Group dazzled with its high-precision CNC machining centers, while HSD from Italy showcased cutting-edge five-axis heads and electric spindles.

In Hall 12.1.The Taiwan Exhibitors are TaiChan, Lih Woei ,Innovator, Kuang Yung, Sk Global,Jun Shiau,CYWWM, Chang Tjer,City Tools,Blue Steel,Chia Lung,Kuoming Licom,Shen Ko,Weipinmech,NewsWin Media etc.

.jpg) Meanwhile, in Hall 14.1, SIGE SPA presented its modular Hardware Home series, and Italiana Ferramenta unveiled its next-generation accessories solutions. Aydın Tekstil from Turkey showcased environmentally friendly textiles.

In Hall 15.1, Schattdecor unveiled its Fineflex series, merging modern design and eco-friendly materials. REHAU showcased its sleek RAUKANTEX Pigmento edgeband, offering seamless aesthetics for panel furniture. AICA debuted its customizable, eco-friendly home adhesives and films. DIC presented its famed HARTMANN ink and new moisture-resistant PUR products. DewertOkin exhibited an intelligent snoring control system with innovative sensor technology.

A Feast of Ideas

The exhibition will not only be a showcase of products but also a hub of ideas and discussions. The VSIL Forum, themed " Design Utopia - Global Furniture "Design & Supply Chain" Innovation," will bring together international designers and industry leaders from Schattdecor, Hettich and Domus Line to explore collaborative innovation between design and the supply chain.

Meanwhile, discussions on environmental sustainability and edge banding technology will highlight the industry's commitment to innovation and responsible practices. Awaiting participants from day two of the exhibition, the VSIL Forum will explore environmental protection and sustainability with experts from Europe, LINAK, SIMALFA®, and China’s Home Color Research Institute. They will discuss practical applications of sustainable development concepts in the home industry. The Boundless Design Forum, titled " Crafting the Perfect Edge - 2024 Panel Furniture Forum on Advanced Edgebanding Techniques" is poised to feature industry experts from IMA Schelling, Henkel, REHAU, and Renolit to examine international cutting-edge edge banding technology and solutions.

In parallel, partnering with the Asia Color Trend Book, the VSIL Gallery 2024 is set to captivate visitors with its visual delights, inviting them to immerse themselves in the themes of "Re-route" and "Coexistence." Through personalized color and material displays, the exhibition aims to inspire creativity and foresight, setting the stage for future aesthetic trends in the furniture industry.

Source: interzum guangzhou 2024

Meanwhile, in Hall 14.1, SIGE SPA presented its modular Hardware Home series, and Italiana Ferramenta unveiled its next-generation accessories solutions. Aydın Tekstil from Turkey showcased environmentally friendly textiles.

In Hall 15.1, Schattdecor unveiled its Fineflex series, merging modern design and eco-friendly materials. REHAU showcased its sleek RAUKANTEX Pigmento edgeband, offering seamless aesthetics for panel furniture. AICA debuted its customizable, eco-friendly home adhesives and films. DIC presented its famed HARTMANN ink and new moisture-resistant PUR products. DewertOkin exhibited an intelligent snoring control system with innovative sensor technology.

A Feast of Ideas

The exhibition will not only be a showcase of products but also a hub of ideas and discussions. The VSIL Forum, themed " Design Utopia - Global Furniture "Design & Supply Chain" Innovation," will bring together international designers and industry leaders from Schattdecor, Hettich and Domus Line to explore collaborative innovation between design and the supply chain.

Meanwhile, discussions on environmental sustainability and edge banding technology will highlight the industry's commitment to innovation and responsible practices. Awaiting participants from day two of the exhibition, the VSIL Forum will explore environmental protection and sustainability with experts from Europe, LINAK, SIMALFA®, and China’s Home Color Research Institute. They will discuss practical applications of sustainable development concepts in the home industry. The Boundless Design Forum, titled " Crafting the Perfect Edge - 2024 Panel Furniture Forum on Advanced Edgebanding Techniques" is poised to feature industry experts from IMA Schelling, Henkel, REHAU, and Renolit to examine international cutting-edge edge banding technology and solutions.

In parallel, partnering with the Asia Color Trend Book, the VSIL Gallery 2024 is set to captivate visitors with its visual delights, inviting them to immerse themselves in the themes of "Re-route" and "Coexistence." Through personalized color and material displays, the exhibition aims to inspire creativity and foresight, setting the stage for future aesthetic trends in the furniture industry.

Source: interzum guangzhou 2024

XYLEXPO 2024: JUST THREE MONTHS…

- 2024-02-29

…before the official opening of the 2024 edition, registrations keep flowing in from companies that decide to exhibit in Milan, in Halls 1 and 3 of Fieramilano Rho, at Xylexpo, the biennial international exhibition of wood and furniture industry technology scheduled next May 21 to 24. So far, just below 250 exhibitors will attend the event – back to its traditional calendar slot in May – presenting plants, solutions, products and technology that will provide plenty of international visitors with an upgrade on all process stages, from primary operation to the most innovative finishing. “Today more than ever, exhibitions accurately reflect the market health, and Xylexpo definitely offers a clear picture of the current situation of our industry, in Italy and globally”, said Dario Corbetta, exhibition director. “The record revenues of recent years have long been replaced by an inevitable reduction of orders. This situation was expected, but nevertheless, it caused many companies – despite high revenues supported by outstanding orders – to wait and see, to suspend investments in some activities, exhibitions on top of all. In recent weeks, many companies are reconsidering such decisions, but Xylexpo 2024 will inevitably have a different face”. At FieraMilano-Rho, many key players of technology will be attending, leveraging the opportunity to be under the spotlight in a challenging landscape, with many visitors expected from Italy and abroad. SCM, Felder, Naxing, KDT and several “famous” German and international brands have renovated their trust in an event that, don’t forget, is not just attractive for buyers, importers and international operators, but is located in one of the world’s most important markets for wood and furniture technology, with total demand exceeding one billion euro. Source: XYLEXPO 2024

INDIAWOOD 2024 - A Quarter Century of Excellence, Innovation and Global Dominance

- 2024-02-23

Bangalore, February 22, 2024 - The grand inauguration of INDIAWOOD 2024 today marks a significant milestone for the global woodworking and furniture manufacturing industry. Hosted at the Bangalore International Exhibition Centre from 22-26 February, INDIAWOOD 2024 underscores the industry's evolution and India's pivotal role in the global woodworking and furniture manufacturing market.

.jpg) Over the years, the event has established itself as the premier platform for innovation, collaboration, and growth in the woodworking and furniture manufacturing industry, not just in Asia but globally. The 2024 edition of INDIAWOOD sprawls over 75,000 square meters, showcasing over 950 exhibitors from more than 50 countries and will feature focused participation from Germany, Italy, France, Malaysia, USA and Taiwan. This year, the event is poised to welcome over 75,000 visitors, reflecting the industry's vibrant dynamics and the event's crucial role in shaping future trends. The exhibitors from Taiwan are CHI ING, GOODTEK, HOLYTEK, EXCELLENT,KUOMING,INNOVATOR,LEADERMAC, POWERMAX,SK GLOBAL,SANDERSON,LASERMAN,YOW CHERNG,TONG FONG,WENCHIH,RKE,NEWSWIN MEDIA,etc..

Over the years, the event has established itself as the premier platform for innovation, collaboration, and growth in the woodworking and furniture manufacturing industry, not just in Asia but globally. The 2024 edition of INDIAWOOD sprawls over 75,000 square meters, showcasing over 950 exhibitors from more than 50 countries and will feature focused participation from Germany, Italy, France, Malaysia, USA and Taiwan. This year, the event is poised to welcome over 75,000 visitors, reflecting the industry's vibrant dynamics and the event's crucial role in shaping future trends. The exhibitors from Taiwan are CHI ING, GOODTEK, HOLYTEK, EXCELLENT,KUOMING,INNOVATOR,LEADERMAC, POWERMAX,SK GLOBAL,SANDERSON,LASERMAN,YOW CHERNG,TONG FONG,WENCHIH,RKE,NEWSWIN MEDIA,etc..

.jpg) Furniture & Kitchen manufacturers, architects, interior designers, timber traders, saw millers, builders, contractors, hardware distributors, dealers from all over the world and neighbouring countries such as Nepal, Bhutan, Bangladesh, Sri Lanka, the Middle East participate in huge numbers at the event, reiterating its position as the melting pot for the “woodworking and furniture manufacturing” Industry.

Celebrating 25 Years of Excellence and Innovation

As INDIAWOOD approaches its 25th anniversary in 2025, the event has emerged as the cornerstone for the industry, driving development, sustainability, and growth. By providing a platform for businesses to expand their markets, forge international partnerships, and explore new opportunities, INDIAWOOD has played a pivotal role in shaping the economic landscape of the woodworking and furniture manufacturing sector. The event has contributed to job creation, skill development, and the promotion of exports, underpinning the industry's contribution to economic development and prosperity.

Furniture & Kitchen manufacturers, architects, interior designers, timber traders, saw millers, builders, contractors, hardware distributors, dealers from all over the world and neighbouring countries such as Nepal, Bhutan, Bangladesh, Sri Lanka, the Middle East participate in huge numbers at the event, reiterating its position as the melting pot for the “woodworking and furniture manufacturing” Industry.

Celebrating 25 Years of Excellence and Innovation

As INDIAWOOD approaches its 25th anniversary in 2025, the event has emerged as the cornerstone for the industry, driving development, sustainability, and growth. By providing a platform for businesses to expand their markets, forge international partnerships, and explore new opportunities, INDIAWOOD has played a pivotal role in shaping the economic landscape of the woodworking and furniture manufacturing sector. The event has contributed to job creation, skill development, and the promotion of exports, underpinning the industry's contribution to economic development and prosperity.

.jpg) From 2025 INDIAWOOD will alternate locations between Delhi and Bengaluru each year, ensuring a meticulously curated, focused, and internationally recognized platform to champion the industry's growth and global aspirations.

Woodworking Industry- The Backbone of India's Economic Landscape

The woodworking and furniture manufacturing sector is a vital component of India's booming economy. Contributing significantly to employment, manufacturing output, and export, the industry represents a blend of traditional craftsmanship and modern innovation. India's economic dominance, particularly in this sector, is a reflection of its capacity to blend high-skilled labour with cutting-edge technology, making it a global hub for furniture manufacturing and woodworking.

Sonia Prashar, Managing Director and Chairperson of the Board, NuernbergMesse India, stated, "As we inaugurate INDIAWOOD 2024, we are not just celebrating the present achievements but also laying the groundwork for the future. The woodworking and furniture manufacturing industry is at the cusp of a new era, driven by digital transformation and sustainability. Our vision is to propel India and INDIAWOOD to the forefront of this evolution, making it a global benchmark for innovation and excellence."

Sivakumar Venugopal, Member of the Management Board at NuernbergMesse India, added, "The 25th year of INDIAWOOD next year is a significant milestone that celebrates not just the longevity but also the impact of this event on the global stage. It is a reflection of our commitment towards fostering growth, innovation, and collaboration across continents. We are dedicated to showcasing the prowess of the Indian woodworking and furniture manufacturing industry to the world."

About INDIAWOOD:

INDIAWOOD 2024 showcase groundbreaking technologies and materials that are poised to redefine the future of woodworking. From high-performance adhesives and coatings to sustainable timber harvesting practices and eco-friendly finishes, INDIAWOOD will demonstrate the industry's commitment to sustainability and innovation. Visitors will also be able to explore the latest advancements in engineered wood products, such as cross-laminated timber (CLT), laminated veneer lumber (LVL), and glue-laminated timber (glulam).

From 2025 INDIAWOOD will alternate locations between Delhi and Bengaluru each year, ensuring a meticulously curated, focused, and internationally recognized platform to champion the industry's growth and global aspirations.

Woodworking Industry- The Backbone of India's Economic Landscape

The woodworking and furniture manufacturing sector is a vital component of India's booming economy. Contributing significantly to employment, manufacturing output, and export, the industry represents a blend of traditional craftsmanship and modern innovation. India's economic dominance, particularly in this sector, is a reflection of its capacity to blend high-skilled labour with cutting-edge technology, making it a global hub for furniture manufacturing and woodworking.

Sonia Prashar, Managing Director and Chairperson of the Board, NuernbergMesse India, stated, "As we inaugurate INDIAWOOD 2024, we are not just celebrating the present achievements but also laying the groundwork for the future. The woodworking and furniture manufacturing industry is at the cusp of a new era, driven by digital transformation and sustainability. Our vision is to propel India and INDIAWOOD to the forefront of this evolution, making it a global benchmark for innovation and excellence."

Sivakumar Venugopal, Member of the Management Board at NuernbergMesse India, added, "The 25th year of INDIAWOOD next year is a significant milestone that celebrates not just the longevity but also the impact of this event on the global stage. It is a reflection of our commitment towards fostering growth, innovation, and collaboration across continents. We are dedicated to showcasing the prowess of the Indian woodworking and furniture manufacturing industry to the world."

About INDIAWOOD:

INDIAWOOD 2024 showcase groundbreaking technologies and materials that are poised to redefine the future of woodworking. From high-performance adhesives and coatings to sustainable timber harvesting practices and eco-friendly finishes, INDIAWOOD will demonstrate the industry's commitment to sustainability and innovation. Visitors will also be able to explore the latest advancements in engineered wood products, such as cross-laminated timber (CLT), laminated veneer lumber (LVL), and glue-laminated timber (glulam).

.jpg) Spotlight will also be on the integration of digital technologies into woodworking processes, including CNC machining, robotics, smart edge banding solutions for seamless finishing, and laser cutting systems for precise cutting and engraving.

INDIA MATTRESSTECH + UPHOLSTERY SUPPLIES EXPO (IME), held concurrently will have on display the latest technology for mattress production machinery and supplies, mattress finishing machinery and supplies, production tools and equipment, upholstery production technology, bed systems, new materials etc.

The third edition of 'Wood+ in Architecture and Design (WAD)', one day conference, to be held on the 24th of February will bring together Architects, Structural Engineers, Designers and Mass-Timber manufacturers to explore through panel discussions, expert presentations, and interesting case studies the application of wood as a construction material. www.w-a-d.in.

Newest launch SURFACE IN MOTION, one day conference on decorative surfaces for wood-based materials, will be held on 23rd February; where top experts from Europe and India will present topics such as decor design, the latest surface technologies, production processes and trends.

Spotlight will also be on the integration of digital technologies into woodworking processes, including CNC machining, robotics, smart edge banding solutions for seamless finishing, and laser cutting systems for precise cutting and engraving.

INDIA MATTRESSTECH + UPHOLSTERY SUPPLIES EXPO (IME), held concurrently will have on display the latest technology for mattress production machinery and supplies, mattress finishing machinery and supplies, production tools and equipment, upholstery production technology, bed systems, new materials etc.

The third edition of 'Wood+ in Architecture and Design (WAD)', one day conference, to be held on the 24th of February will bring together Architects, Structural Engineers, Designers and Mass-Timber manufacturers to explore through panel discussions, expert presentations, and interesting case studies the application of wood as a construction material. www.w-a-d.in.

Newest launch SURFACE IN MOTION, one day conference on decorative surfaces for wood-based materials, will be held on 23rd February; where top experts from Europe and India will present topics such as decor design, the latest surface technologies, production processes and trends.

.jpg) Source: INDIA WOOD 2024

Source: INDIA WOOD 2024